arizona real estate tax rate

Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the. Establishing tax rates estimating market value and then receiving the tax.

Property Taxes For In Arizona Everything You Need To Know Kake

There are three primary steps in taxing property ie devising tax rates estimating property market values and taking in tax revenues.

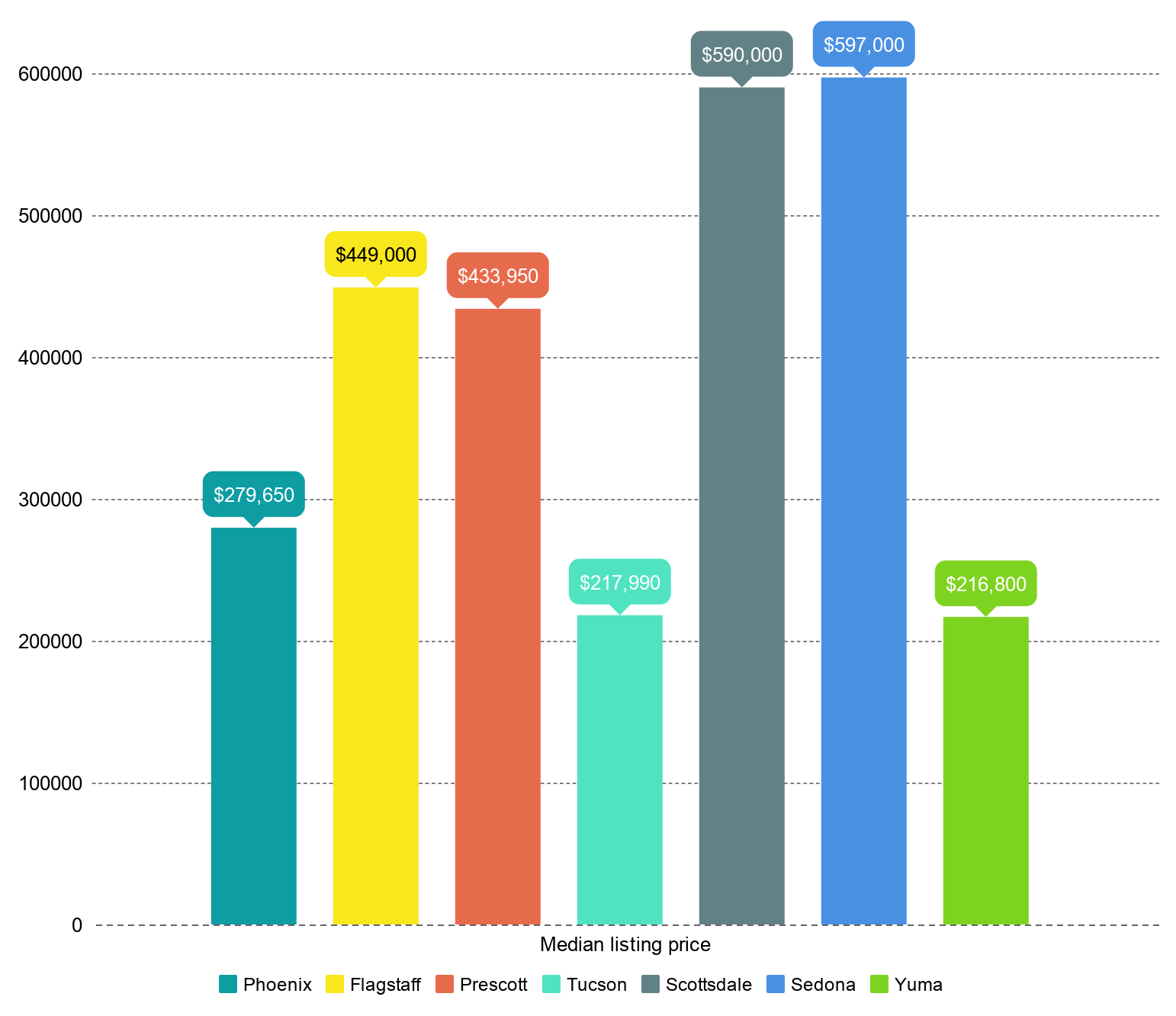

. 10105 E Via Linda Ste 103 26 Scottsdale AZ 85258 Arizona. Arizona is ranked 30th of the 50. If a property is mortgaged the property.

Ad Find The Arizona Real Estate Records You Need In Minutes. In general there are three aspects to real property taxation. A property tax bill can be paid electronically or by mail to the County Treasurer of the county in which the property is located.

Maricopa County collects on average 059 of a propertys. Taxing units include city county governments and a. Glendale determines tax rates all within Arizona statutory rules.

1600 West Monroe Street. Get Accurate Arizona Records. The median property tax in Maricopa County Arizona is 1418 per year for a home worth the median value of 238600.

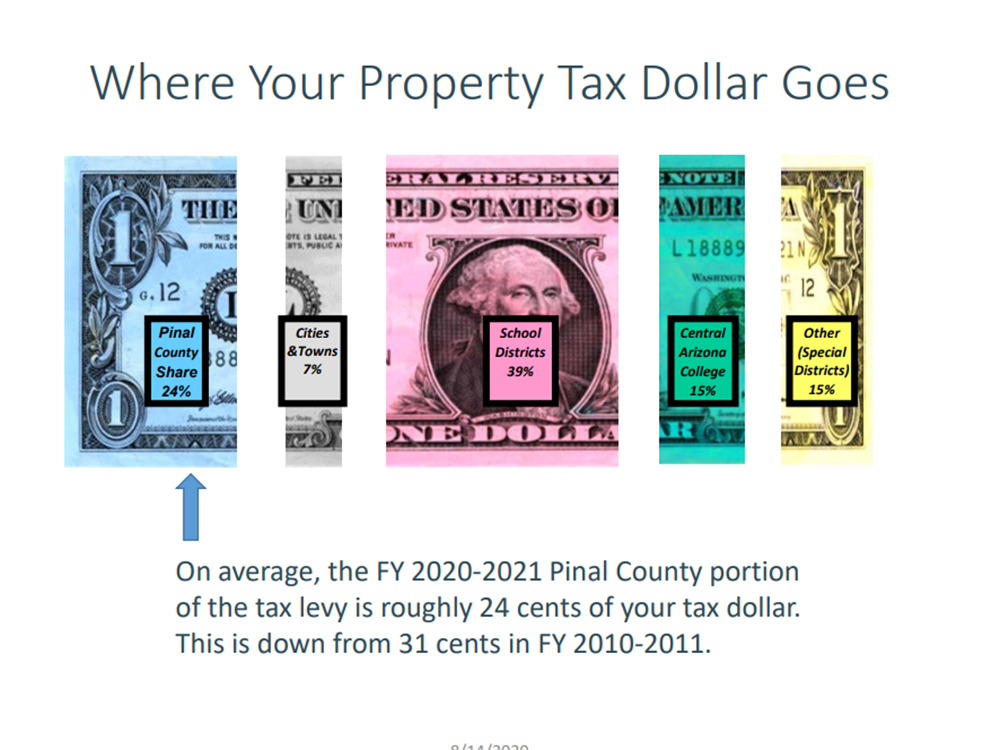

Arizona Department of Revenue. The tax rate is calculated based on the tax levy for each taxing authority and assessed values by the County Assessor. Download Residential Rental Resources and Information Card PDF Learn About Tax Changes at Cities and Towns.

Ad Find The Arizona Real Estate Records You Need In Minutes. The total amount that will be billed in property taxes. TGAZ Investment LLC.

Arizonas median income is 59367 per year so the median yearly property tax paid by Arizona residents amounts to approximately of their yearly income. Under Arizona law the government of Mesa public colleges. By the end of September 2022 Pima County will mail approximately 455000 property tax bills for the various property taxing jurisdictions within the County.

Here is a list of states in order of lowest ranking property tax to highest. Visit Our Website For Records You Can Trust. Property taxes in Arizona are paid in two semi-annual.

Taxing units include Chandler county governments. Arizona gives real estate taxation rights to thousands of community-based governmental entities. Counties in Arizona collect an average of 072 of a propertys assesed fair.

Although they are limited property tax exemption programs do exist in Arizona and might be the best option for you or a senior loved one in the event the property owner is a widowwidower or. If you need further assistance please call 602716-RENT 7368 or email. How Peoria Real Estate Tax Works.

Generally taxing districts tax assessments are. Get Accurate Arizona Records. Visit Our Website For Records You Can Trust.

We created this site to help you to. Real Estate Tax Rate. There are three basic steps in taxing real estate ie formulating tax rates estimating property values and taking in payments.

However left to the county are appraising real estate sending out bills receiving the tax carrying out compliance efforts and. The typical Arizona homeowner pays just 1578 in property taxes annually saving them 1000 in comparison to the national average. The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000.

What I Need To Know About Property Taxes In Arizona

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

U S Cities With The Highest Property Taxes

Governor S Task Force On High County Property Tax Rates Report Of The Subcommittee Arizona State Government Publications Arizona Memory Project

Surprise Property Tax Rates Remaining Same The Daily Independent At Yourvalley Net

County Approves Tax Rates Levies Inmaricopa

Which States Have The Lowest Tax Rates Seniorliving Org

Slew Of Bills Signed By Gov Pritzker Helps Propel Illinois Property Taxes To Nations Highest Wirepoints Wirepoints

How High Are Property Taxes In Your State Tax Foundation

Arizona Property Tax Calculator Smartasset

Board Of Supervisors Cuts Property Tax Rate Works To Blunt Inflation In Tentative Fy 2023 Budget All About Arizona News

2021 Tax Rates Assessed Values Arizona Tax Research Association

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

Arizona Vs Florida Moving To Arizona Or Florida Move Us To Scottsdale

County Assessor Should Call Out Those Who Raise Property Tax Bills

Arizona Property Taxes Are Lower Than Most Other States

Property Tax Increases For Arizona Homeowners Arizona School Of Real Estate And Business

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

Why Some Cities In Low Tax States Have The Highest Property Tax Rates